Graduation marks the beginning of your next big chapter—career, independence, and financial responsibility. It’s an exciting transition, but it can also feel overwhelming as new expenses appear and student loans come due.

Magnolia FCU is here to help you build a stable path forward.

1. Start With a Realistic Post-Grad Budget

New grads often face:

• Rent

• Utilities

• Insurance

• Car payments

• Student loan payments

• Groceries

•Work-related expenses

Your first full-time paycheck may feel big—but your expenses grow too.

A good budget keeps everything in balance.

2. Build Your Emergency Fund Early

Aim for $500–$1,000 to start.

Gradually build to 1–3 months of expenses.

This protects you when unexpected bills appear.

3. Understand Your Student Loan Timeline

Most loans begin repayment 6 months after graduation.

Use this window to

• Select a repayment plan

• Update your address & contact info

• Set up auto-pay for interest discounts

• Explore income-driven options if needed

4. Start Building Credit Responsibly

Your credit score affects:

• Apartment approval

• Car loan rates

• Insurance premiums

• Future mortgage eligibility

Start with:

• Paying all bills on time

• Keeping credit card balances low

• Limiting new credit inquiries

5. Consider Retirement Early (Even a Small Start Matters)

Employer 401(k)? Get the match!

Even $30–$50 per paycheck builds long-term wealth through compound interest.

6. Watch for Lifestyle Creep

As income rises, spending often rises too.

Avoid the trap—upgrade slowly, not all at once.

7. Plan Your Career Path

Your early career sets the foundation for future earning potential.

Consider:

• Certifications

• Continuing education

• Networking

• Mentorship

• Job-hunting timelines

A career plan = a financial plan.

Bottom Line

Life after graduation comes with big opportunities and new responsibilities. When you budget wisely, manage debt proactively, and build healthy financial habits, you set yourself up for long-term success. Magnolia FCU is here to support you through every step of adulthood.

Related Articles

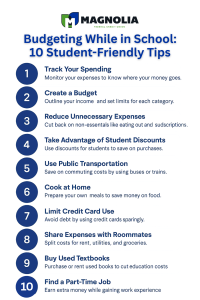

How to Build a Budget As a Student

Understanding Student Loans and Their Long-Term Impact

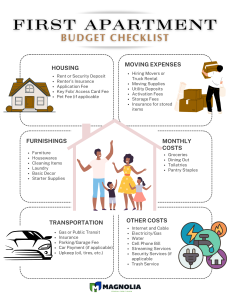

Ways to Achieve Your Goal of Renting Your First Apartment

Preparing Kids for Financial Success

Want more financial tips?

More Financial Resources