Life has a way of surprising us—sometimes with opportunity, sometimes with unexpected expenses. A strong financial foundation includes one of the most important tools for stability: a reliable emergency fund. This buffer protects your budget, reduces stress, and helps you stay in control even when the unexpected happens.

At Magnolia Federal Credit Union, we want every member to have access to the confidence that comes from knowing you’re prepared. Whether you’re starting from scratch or rebuilding after a setback, this guide will help you create a savings strategy that supports your present and strengthens your future.

What Is an Emergency Fund—and Why Does It Matter?

An emergency fund is money set aside specifically for unplanned expenses, such as:

• Medical bills

• Car repairs

• Job loss or reduced hours

• Home maintenance

• Travel for urgent family matters

Without savings, many people turn to credit cards, payday lenders, or high-interest loans during emergencies. A well-built emergency fund helps you stay independent and avoid debt traps that can spiral quickly.

How Much Should You Save?

There’s no single magic number, but here’s a helpful guide:

• Minimum starter goal: $500-$1,000

• Stability goal: 1 month of essential expenses

• Full protection: 3-6 months of essential expenses

If you’re supporting children, paying a mortgage, or have irregular income, aiming toward the higher end provides more security.

How to Build Your Emergency Fund (Even If Money Feels Tight)

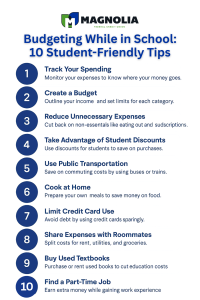

The most important part: start small and stay consistent.

Here’s a simple, achievable plan:

1. Set your starter goal

Choose a realistic amount—maybe $300, $500, or $1,000.

Reaching this first milestone builds confidence and momentum.

2. Automate your savings

Set a transfer to run after every paycheck.

Even $10–$50 per pay period adds up over time.

3. Make savings visible but not too accessible

Keep your emergency fund in a separate savings account so you’re not tempted to dip into it for everyday spending.

4. Use found money wisely

Tax refunds, bonuses, overtime, or cash gifts can dramatically boost your emergency fund.

5. Cut one small expense temporarily

Even one subscription or weekly takeout swap can free enough money to push you toward your goal.

What NOT to Use Your Emergency Fund For

Your emergency fund should be used only for:

• Urgent

• Unexpected

• Necessary

• Time-sensitive

Not for:

• Vacations

• Holiday shopping

• Routine bills

• Regular vehicle maintenance (this should be budgeted separately)

Protect the purpose of your emergency fund to protect yourself.

After the Emergency Fund: Start Growing Your Wealth

Once your emergency fund is in a healthy place, you can shift your focus toward long-term savings and investment goals:

• Retirement accounts (401(k), IRA)

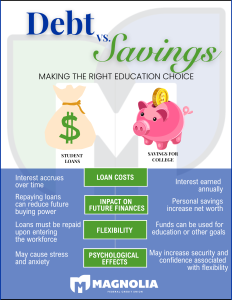

• Education savings

• Home down payments

• Business startup funds

• Major purchases (new car, appliances, renovations)

Savings creates stability. Investing creates opportunity.

Why Savings Matter in a CDFI Community

For many households served by CDFIs, financial shocks can cause long-term setbacks. By building savings—

• You depend less on high-cost lenders

• You strengthen your credit

• You improve generational stability

• You gain control over your financial future

A strong savings foundation transforms financial vulnerability into resilience.

Key Takeaways

• Start small, save consistently

• Protect your emergency fund for true emergencies

• Build toward 3-6 months of essential expenses

• Keep savings separate and automated

• Grow into long-term financial goals once your safety net is secure

Let Us Help You Build Your Safety Net

If you’re ready to start your emergency fund—or want help creating a personalized savings plan—our team is here for you.

Related Articles

The 50/30/20 Rule for Saving

Retirement, Investing & Long-Term Wealth: Preparing for the Future You Deserve

Passive Income: An Overview

Schedule a free Financial Counseling Session with Magnolia FCU today.

More Financial Resources