Financial wellness isn’t just about numbers, it’s about confidence, control, and the ability to make choices that support the life you want to build. Whether you’re creating your first budget, trying to improve your credit, or looking ahead to long-term goals, a strong foundation is the most important part of your journey.

At Magnolia Federal Credit Union, our goal is to provide clear guidance, approachable tools, and personal support so you can take every step forward with certainty. This guide will walk you through the basics of building that foundation—and set the stage for long-term financial success.

Start With a Clear Picture of Where You Are

You can’t build a plan without knowing your starting point. Take time to gather the essentials:

• Income – Note your take home pay (not just your salary).

• Recurring expenses – Rent/mortgage, utilities, groceries, transportation, childcare, subscriptions, etc.

• Debts – Credit cards, loans, medical bills, personal or payday loans.

• Savings – Emergency fund, checking account buffer, retirement contributions.

• Credit Profile – Scores and what’s affecting them.

Seeing everything, not just what you think you spend, helps you make informed decisions instead of educated guesses.

Create a Realistic Budget That Works With Your Life

A budget shouldn’t feel restrictive. It should feel empowering. The goal is simple: give every dollar a job so you’re always in control.

Try starting with these steps:

- Calculate your essential expenses.

- Identify areas of overspending — dining out, shopping, subscriptions, fees.

- Set spending limits that give you structure but still allow enjoyment.

- Review weekly. Frequent touch-points keep you accountable.

Some members benefit from the 50/30/20 guide:

•50% needs

•30% wants

•20% savings/debt payoff

But remember, your budget should fit your lifestyle, family, and goals.

Choose One Financial Focus Area for the Next 90 Days

Trying to improve everything at once can feel overwhelming. Instead, choose ONE priority for the next three months:

•Build a $500-$1,000 emergency fund

•Pay down a high-interest credit card

•Track spending every week

•Improve your credit score

•Save for a specific goal (home, car, vacation)

Ninety days gives you enough time to see real progress without feeling like you’ve committed to a massive life overhaul.

Build Habits, Not Just Goals

Habits are more powerful than intentions. Here are a few simple ones that make a big difference:

•Automate savings – even $25 per paycheck adds up.

•Set bills to auto-pay to avoid fees and late payments.

•Review your accounts weekly to stay aware and make adjustments.

•Use alerts for low balances, upcoming payments, and spending thresholds.

These small routines create long-term stability.

Understand Your Credit—And Use It Wisely

Your credit score affects almost everything: interest rates, approval odds, insurance premiums, even employment in some industries.

To strengthen your credit over time:

• Pay bills on time – payment history is the biggest factor.

• Keep card balances below 30% of your limit (lower is even better).

• Avoid unnecessary credit inquiries.

• Check your credit regularly for errors or fraud.

If your score needs work, we can walk you through a personalized improvement plan.

Plan for Setbacks Before They Happen

Life doesn’t always go as planned and that’s normal. Job changes, medical bills, household repairs, inflation, and unexpected expenses can disrupt even the best-built budget.

A strong foundation includes:

• Emergency savings

• A plan for priority expenses

• Awareness of assistance programs

• A counselor or advisor to call when things shift

With preparation, a setback doesn’t have to become a crisis.

Why CDFI-Aligned Support Matters

Magnolia FCU is committed to serving and uplifting our community. As part of our mission:

• We offer non-judgmental, one-on-one financial counseling

• We help members improve credit, reduce debt, and build savings.

• We provide tools designed for underserved and underbanked households.

• We focus on long-term financial empowerment – not quick fixes.

Your success is community success.

Takeaways for Your Financial Foundation

• Know your starting point

• Budget with intention

• Choose one focus area for 90 days

• Build healthy financial habits

• Strengthen your credit responsibly

• Prepare for setbacks

• Use your credit union as a partner

We’re Here to Help You Start Strong

No matter where you’re beginning, you don’t have to do it alone.

Our counselors are ready to help you build a plan that works for your goals, your family, and your future.

Related Articles

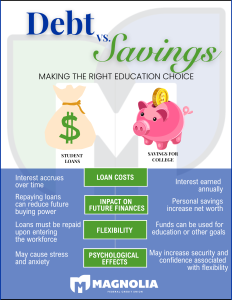

Managing and Getting Out of Debt

The Four Pillars of Financial Health

Mastering Debt: How to Borrow Smart and Build Financial Stability

Ready to take your first step?

Schedule a Financial Counseling Session with Magnolia FCU today.

More Financial Resources