Student loans can open the door to education—but they also come with long-lasting financial responsibilities. Before borrowing (or while repaying), it’s important to understand exactly how student loans work and how they influence your future financial life.

Magnolia FCU is committed to helping students and families make informed decisions.

1. Know the Types of Student Loans

Federal Loans

• Typically lower interest rates

• Flexible repayment plans

• Income-driven repayment available

Private Loans

• Credit-based

• Rates vary widely

• Fewer repayment options

Always exhaust federal options before turning to private loans.

2. Interest Starts Sooner Than You Think

Unsubsidized loans begin accruing interest immediately.

Subsidized loans begin after you leave school.

Small balances can grow quickly if they’re not monitored.

3. Your Future Monthly Payment Will Depend on More Than the Principal

What affects payment size:

• Loan type

• Interest rate

• Total borrowed

• Repayment plan

• Whether interest capitalizes

Many borrowers don’t realize their payment could be higher than expected.

4. Student Loan Debt Impacts Future Financial Decisions

Loan repayment can influence your ability to:

• Buy a home

• Save for retirement

• Qualify for other loans

• Afford major purchases

Understanding this early helps you plan for stability later.

5. You Don’t Have to Struggle Alone

There are many options for managing repayment:

• Income-driven plans

• Loan consolidation

• Forbearance and deferment

• Refinancing (weigh carefully—loss of federal protections)

Magnolia FCU can guide you through understanding these options based on your situation.

6. Paying Even Small Amounts in School Helps

$10–$25 monthly payments during school can reduce years of interest later.

7. Borrow Only What You Need

Refund checks can be tempting, but remember:

Loan money today = repayment tomorrow.

Borrow strategically, not emotionally.

Bottom Line

Student loans can be manageable with the right strategy and awareness. Magnolia FCU helps students and families understand the long-term impact so they’re set up for success—not stress.

Infographics

Related Articles

Life After Graduation: Launching Your Financial Path

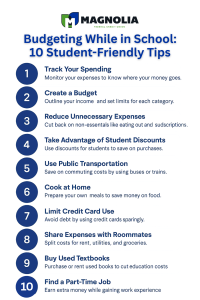

How to Build a Budget As a Student

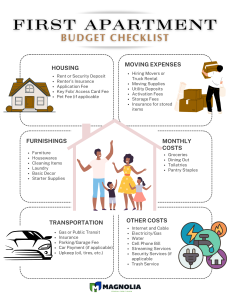

Ways to Achieve Your Goal of Renting Your First Apartment

Want more financial tips?

More Financial Resources