Buying a home is more than a monthly mortgage payment. Many first-time buyers underestimate the ongoing costs that come with owning a property.

Understanding these true costs helps you budget accurately and avoid financial surprises.

1. Property Taxes

Your tax bill can change yearly based on assessments and local government budgets.

2. Homeowners Insurance

Coverage varies by home value, location, and risk factors—plan for annual increases.

3. Utilities & Basic Services

Homeowners often pay more than renters for:

• Water

• Electricity

• Gas

• Trash

• Internet

• Sewer fees

Older homes may have higher utility consumption.

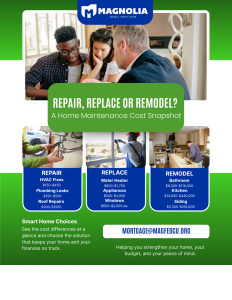

4. Maintenance & Repairs

The average homeowner spends 1–4% of the home’s value per year on maintenance.

This includes:

• HVAC

• Plumbing

• Roofing

• Landscaping

• Pest control

• Appliance repair/replacement

Unexpected repairs can cost thousands.

5. HOA or Community Fees

If applicable, these fees cover:

• Landscaping

• Amenities

• Community maintenance

• Roof or exterior care (for townhomes/condos)

6. Closing Costs & Ongoing Fees

• Property inspections

• Title insurance

• Recording fees

• Appraisal fees

• Mortgage insurance (if applicable)

Some fees recur annually.

7. Long-Term Home Upgrades

Over time, you may need to budget for:

• Flooring

• Painting

• Window replacement

• Security upgrades

• Energy-efficiency improvements

These increase comfort and value—but cost money.

Bottom Line

The true cost of homeownership extends far beyond the mortgage. Magnolia FCU helps members understand every part of the equation so you can buy confidently and budget wisely.

Infographics

Related Articles

7 Reasons Not to Skip Your Home Inspection

Why Does My Mortgage Lender Need So Much Paperwork?

Mistakes First-Time Homebuyers Make

Planning Big Purchases & Homeownership: Making Major Financial Decisions with Confidence

Want more financial tips?

More Financial Resources