College life comes with freedom, opportunity, and let’s be honest, a lot of new expenses. Between textbooks, food, housing, transportation, and social life, it’s easy for money to disappear faster than you expect. Building a budget as a student helps you stay in control and avoid unnecessary debt, while developing financial habits that carry you into adulthood.

Magnolia Federal Credit Union is here to make budgeting simple, realistic, and something you can actually stick to.

1. Know Your Real Income

Student income looks different for everyone. Yours may come from:

• Part-time work

• Work-study

• Refund checks

• Scholarships or grants

• Financial help from family

• Savings

Add everything together to know your true monthly spendable amount—not the total of your student loans.

2. Separate Your Needs vs Wants

College is fun, but staying within a budget requires balance.

Needs include:

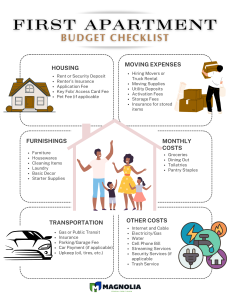

• Housing

• Food

• Transportation

• Phone bill

• Required textbooks

• Personal essentials

Wants include:

• Eating out

• Streaming services

• Trips or events

• New clothes

• Coffee or convenience snacks

Seeing the difference helps you redirect spending when money gets tight.

3. List Your Fixed & Variable Expenses

Fixed = predictable

Variable = flexible

Fixed expenses:

• Rent

• Meal plans

• Monthly bus pass

• Insurance

• Subscriptions

Variable expenses:

• Groceries

• Gas

• Entertainment

• Personal items

Start tracking these weekly—you’ll be surprised how quickly small purchases add up.

4. Use the 50/30/20 Rule (Student Edition)

A realistic breakdown for student life might be:

• 50% Needs

• 30% Personal/Discretionary

• 20% Savings/Debt Prep

Savings can include:

• Emergency fund

• Future moving expenses

• Next semester’s books

Even $10–$20 per week makes a difference.

5. Use Student-Friendly Tools

Good budgeting apps include:

• Mint

• EveryDollar

• PocketGuard

• Notion templates

• Simple Excel/Google Sheets

Magnolia FCU also offers budget worksheets and counseling for students who need help getting started.

6. Expect the Unexpected

College comes with surprise expenses:

• Lab fees

• Parking tickets

• Class materials

• Repairs or medical costs

Build a cushion if you can—even $100–$250 helps avoid panic.

7. Review Your Budget Monthly

Your income or class load may change each semester.

Adjust your budget as needed so it fits your real life, not an ideal version of it.

Bottom Line

Budgeting as a student doesn’t have to be complicated. With a little planning and consistency, you can enjoy college life while building smart financial habits. Magnolia FCU is here to support you every step of the way.

Infographics

Related Articles

Life After Graduation: Launching Your Financial Path

Understanding Student Loans and Their Long-Term Impact

Your Financial Roadmap: Building a Strong Foundation for Your Future

How to Build a Budget As a Student

Want more financial tips?

More Financial Resources