Buying your first home is exciting—but it’s also full of decisions that can affect your finances for decades. Many first-time buyers unknowingly fall into common traps that can lead to stress, unexpected expenses, or long-term budget strain.

At Magnolia Federal Credit Union, we want you to start your homeownership journey with confidence. Here are the most common mistakes first-time buyers make—and how to avoid them.

1. Shopping for Homes Before Knowing What You Can Afford

It’s easy to fall in love with listings online, but your price range should come from your budget, not the housing market.

A comfortable payment should include:

✔ Mortgage

✔ Property taxes

✔ Insurance

✔ Utilities

✔ Maintenance

✔ HOA fees (if applicable)

Get pre-approved first so you know exactly where you stand.

2. Focusing Only on the Mortgage Payment

The mortgage is just one piece. New homeowners are often surprised by:

• Repairs

• Landscaping

• Pest control

• Appliance replacement

• Higher utility costs

• Annual taxes and insurance increases

A realistic budget prevents surprises.

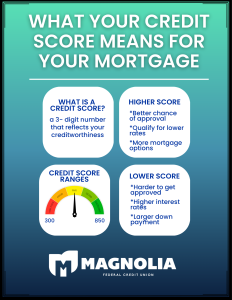

3. Ignoring Your Credit Score

Your credit score can affect your interest rate by thousands of dollars over the life of your loan.

Don’t ignore small issues—fixing late payments, reducing credit card balances, or disputing errors can make a significant difference.

4. Not Saving Enough for Closing Costs

Down payments get all the attention, but closing costs (3–6% of the home price) can sneak up on buyers.

These include:

• Origination fees

• Appraisal

• Title insurance

• Prepaid taxes & insurance

Having a cushion ensures you don’t drain your savings.

5. Falling in Love at First Sight

Buying a home is emotional, but it’s also a major investment. Don’t overlook serious issues like:

• Old roofs

• Foundation cracks

• Mold

• Outdated electrical systems

A beautiful home isn’t always a well-maintained one.

6. Choosing the Wrong Realtor

Your realtor should:

• Know your market

• Respect your budget

• Advocate for you

• Explain the process clearly

Interview a few until you find one you trust.

7. Skipping Professional Advice

Talking to a financial counselor or lender early can save thousands. Magnolia FCU can help you:

• Build a realistic budget

• Understand loan types

• Compare mortgage options

• Plan for long-term affordability

Bottom Line

First-time homebuyers don’t need to be perfect—they just need to be prepared.

Magnolia FCU is here to guide you through every step so you move into your new home with clarity and confidence.

Infographics

Related Articles

What’s the True Cost of Homeownership?

7 Reasons Not to Skip Your Home Inspection

Mistakes First-Time Homebuyers Make

Want more financial tips?

More Financial Resources