Purchasing a home, buying a car, starting a family, or making another large financial decision is exciting, but it can also feel overwhelming. These are moments that shape your life for years to come, so being prepared is essential.

Magnolia FCU is committed to helping members plan major purchases with confidence, clarity, and financial stability. Whether you’re dreaming of your first home or preparing for an important life milestone, this guide will help you make smart decisions from start to finish.

Before You Buy: Evaluate Your Readiness

Major purchases should align with both your financial circumstances and your long-term goals. Consider:

• Do I have an emergency fund?

• Can I comfortably manage the payment each month?

• Will this purchase increase my stability or strain my budget?

• Do I understand the total cost, not just the price tag?

A strong foundation makes big decisions easier and safer.

Homeownership: Steps to Take Before Shopping

Buying a home is one of the biggest financial milestones in anyone’s life. Before you begin:

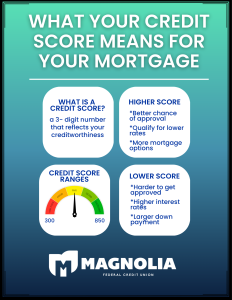

1. Review your credit

Your credit score heavily influences your mortgage rate. Even small improvements can save thousands of dollars over the life of your loan.

2. Calculate your price range

Be realistic about your monthly comfort zone. Don’t forget extra expenses like:

• Property taxes

• Homeowners insurance

• Maintenance

• HOA fees (if applicable)

3. Save for your down payment

The more you’re able to put down, the lower your monthly payment—and the less you’ll pay in interest.

4. Get pre-approved

This strengthens your buying power and helps you shop with clarity.

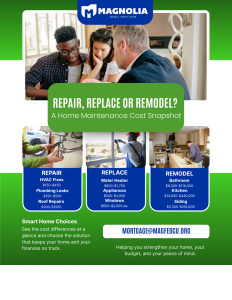

5. Plan for homeownership responsibilities

Even after you move in, the costs don’t stop. Budget for repairs, seasonal maintenance, and unexpected issues.

Cars, Appliances, and Other Major Purchases

Not every big purchase is a home. Other common ones include:

• Vehicles

• HVAC systems

• Major appliances

• Technology or equipment for business

• Home repairs or renovations

For any of these, ask yourself:

•Is now the right time?

•Is this a need or a want?

•What’s the total cost of ownership (maintenance, fuel, repairs, lifespan)?

•Will financing or saving be better in the long run?

Magnolia FCU counselors can walk you through the math so you make the most cost-effective choice.

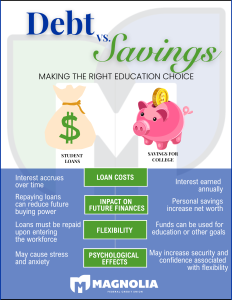

Borrowing Wisely

When financing is necessary, compare:

• APR vs interest rate

• Loan terms

• Total interest paid

• Early payoff penalties

• Monthly payment vs total loan cost

Always choose affordability over excitement.

Why This Matters for a CDFI Community

For many households, big purchases can create long-term strain when not properly planned. Magnolia FCU helps members:

• Avoid predatory lenders

• Access fair loan terms

• Plan for large expenses responsibly

• Strengthen their long-term financial position

• Build generational stability through homeownership

Education is empowerment and empowerment builds wealth.

Key Takeaways

• Prepare before you purchase

• Understand ALL the costs involved

• Protect your budget and savings

• Compare loan options carefully

• Choose long-term stability over short-term excitement

• Get support from trusted financial professionals

We’re Here to Help You Build and Plan for Big Moments

From your first car to your first home, Magnolia FCU is here to guide you every step of the way.

Related Articles

What’s the True Cost of Homeownership?

Creative Ways to Cut the Cost of Homeowners Insurance

Mastering Debt: How to Borrow Smart and Build Financial Stability

Schedule a Financial Counseling Session to plan your next major purchase with confidence.

More Financial Resources